Global eSIM Strategic Business Report 2023:

Spurt in Connected Cars Growth and Demand for Seamless Connectivity Augurs Well

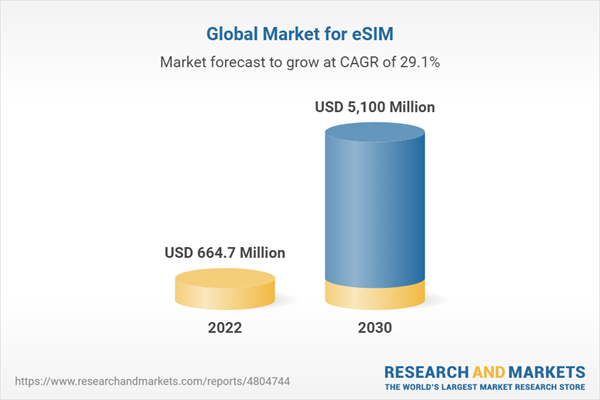

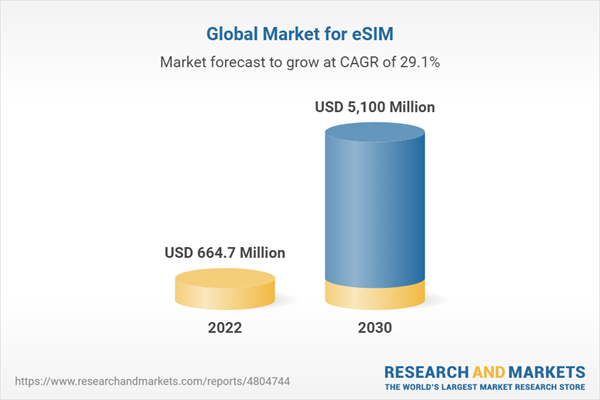

The global market for eSIM estimated at US$664.7 Million in the year 2022, is projected to reach a revised size of US$5.1 Billion by 2030, growing at a CAGR of 29.1% over the analysis period 2022-2030.

M2M, one of the segments analyzed in the report, is projected to record a 28.3% CAGR and reach US$1.6 Billion by the end of the analysis period.

Taking into account the ongoing post pandemic recovery, growth in the Smartphones segment is readjusted to a revised 31.6% CAGR for the next 8-year period.

The U.S. Market is Estimated at $216.2 Million, While China is Forecast to Grow at 32.9% CAGR

The eSIM market in the U.S. is estimated at US$216.2 Million in the year 2022. China, the world’s second largest economy, is forecast to reach a projected market size of US$445 Million by the year 2030 trailing a CAGR of 32.9% over the analysis period 2022 to 2030.

Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 25.5% and 26.9% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 28.6% CAGR.

Select Competitors (Total 38 Featured) –

- Apple Inc

- Deutsche Telekom AG

- Etisalat

- Thales Group

- Giesecke & Devrient GmbH

- IDEMIA

- Infineon Technologies AG

- KORE Wireless Group Inc.

- NTT Docomo Inc.

- NXP Semiconductor N.V.

- Sierra Wireless Inc

- STMicroelectronics

- Telefonica SA

- Vodafone Group Plc.

Key Attributes:

Key Topics Covered:

I. METHODOLOGY

II. EXECUTIVE SUMMARY

1. MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- eSIM – Global Key Competitors Percentage Market Share in 2022 (E)

- Impact of Covid-19 and a Looming Global Recession

- 2020 Marked as a Year of Disruption & Transformation

- World Economic Growth Projections (Real GDP, Annual % Change) for 2020, 2021, & 2022

- eSIMs to Provide a Springboard to Cellular IoT Deployments Hit Hard by COVID-19

- COVID-19 Impact on COMMUNICATIONS TECHNOLOGY

- Global Communications Technology Market Reset & Trajectory – Growth Outlook (In %) For Years 2019 Through 2025 Year YoY Growth (In %) 2019 2.2 2020 -1.2

- COVID-19 Impact Accelerates Shift towards Digitization

- eSIM: An Introduction

- eSIM to Revolutionize the Concept of Connected Devices

- Benefits of eSIM

- eSIM Brings in Opportunities for MVNOs and MNOs to Transform Services

- Meeting the Challenges in IoT Environment Crucial for eSIM Adoption

- embedded SIMs to be the Basis for all Future SIM Innovations

- Managing the eSIM Wave

- eSIMs: The Future

- Recent Industry Activity

- Competitive Market Presence – Strong/Active/Niche/Trivial for Players Worldwide in 2022 (E)

- FOCUS ON SELECT PLAYERS

- MARKET TRENDS & DRIVERS

- eSIMs & IoT: Perfect Elements of Future Transformation

- Global Number of IoT Connected Devices (In Billion Units) for the Years 2016, 2018, 2020, 2022 & 2025

- Global IoT Market (In %) by Industry for the Years 2018 and 2022

- Spurt in Connected Cars Growth and Demand for Seamless Connectivity Augurs Well for eSIM Market

- Global Connected Vehicle Shipments (In Million Units) for the Years 2019, 2021, 2023, and 2025

- Strong Gains for Cellular Segment Foreseen for Automotive V2X Communication

- World Market for Automotive Vehicle-to-Everything (V2X) by Connectivity (2020 & 2027): Percentage Breakdown of Revenues for Dedicated Short Range Communication (DSRC), and Cellular Connectivity

- M2M IoT Market Offers Massive Growth Opportunity

- Importance of Various Technology Enablers in Achieving Industry 4.0 Value Driver

- Global Investments in Industrial IoT (IIoT) Platforms (In US$ Million) for the Years 2018, 2022 and 2025

- Machine-to-Machine (M2M) Communication: A Review

- Cellular M2M Communication Technology: A Novel M2M Communication Model

- Growing Importance of eSIMs inConsumer Electronics Markets

- eSIMs Technology Leaps Forward with Adoption among Major Smartphone Makers

- eSIM Enabled Smartphones as a Share of Global Smartphone Shipments: 2019 Vs 2025

- Global Smartphone Shipments in Million Units: 2015, 2020, & 2025

- Select eSIM Embedded Smartphones by Manufacturer

- Wearable Devices Hold Significant Potential

- Global Shipments of Wearable Devices (in Million Units): 2015-2025

- eSIM Technology Adoption to Accelerate with Arrival of 5G

- 5G Smartphone Sales in Million Units: 2019-2022

- World 5G Mobile Subscriptions: 2019-2025

- eSIM.net Offers 5G eSIM Service

- Hybrid eSIM Management to Leverage Opportunities in both Consumer and M2M Markets

- Healthcare Industry Explores Potential of eSIMs for aiding Remote Medical Consultations

- Industry to Address Security Threats

- Rise of Smart Cities and Focus on Smart Energy Management Opens Up Opportunities

- Smart Meters: Potential Opportunities Ahead

- Global Smart Meters Market in US$ Billion: 2020, 2022, and 2025

- Strategies to Leverage Embedded Module

- GLOBAL MARKET PERSPECTIVE

III. MARKET ANALYSIS

- COMPETITION

For more information about this report visit Research And Markets website site